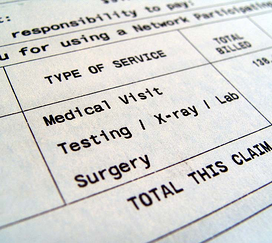

It is difficult to evaluate your own in-house billing operation. Unless you have billing expertise, you simply cannot tell how much money is lost due to improper coding, misuse of modifiers (causing denials and incorrect payments) and lack of effective follow-up.

It is difficult to evaluate your own in-house billing operation. Unless you have billing expertise, you simply cannot tell how much money is lost due to improper coding, misuse of modifiers (causing denials and incorrect payments) and lack of effective follow-up.

To evaluate your medical billing, ask yourself these questions:

How Much Does It Cost to Do Billing in my Office?

Completing the Billing Expense Worksheet on this website will help you determine your costs for your in-house billing staff.

If you’re spending more than the industry standard rate for an outsourced medical billing company of 6 to 8 percent —and it’s likely that you are—you should ask yourself why you would keep this function in-house when you can get better, more accountable service from an outsourced medical billing company with certified coders and all the latest technology.

It’s also important to ask yourself about the return on investment that you receive from your in-house billing staff.

What Is the Quality of the Billing Performed in My Office?

-

What percentage of bills has errors?

-

What percentage of adjustments is made to payments?

-

How frequently are patients billed (weekly, monthly)?

-

Is billing performed on a regular basis?

-

Are reviews done on denied charges?

If you don’t have satisfactory answers to these questions, you may want to revisit the whole matter. A quality outsourced medical billing company will hold itself to a high accuracy rating--at MBR, that requirement is 97% accuracy. They will not simply write numbers off your books without expressed consent from you. We send out patient statements semi-monthly, so your patients will get a statement either at the beginning of the month or mid-month, and we transmit all billing within 24-48 hours of receipt.

We also utilize claim scrubbers to find errors in claims before they have a chance to be denied; but when a claim does get denied, we investigate the reason behind it and gather more information so we can amend the claim, making it payable.

What is My Accounts Receivable?

-

Is your A/R more than two months of your practice income?

-

Is your accounts receivable over 90 days more than 25% of your total receivables?

The answers to these questions should both be, “no.” If it’s “yes,” you may have a problem either with verifying patient eligibility for coverage or with follow up on denied claims. With MBR you can use our online service enabling you to look up real time eligibility on any patient on the date of service, and you can rest assured that we follow up on all denials.

Look for certified coders and certified specialty coders, state-of-the-art technology, electronic transmission of billing from your office to theirs and from theirs to the payers, and real-time eligibility lookups and online bill pay.

You should know intuitively whether your answers to these questions are good or bad for the financial health of your practice. If the prognosis is bad, better contact a qualified outsourced medical billing company today.