Approximately 3 million people have now enrolled in health insurance plans sold through marketplaces created by President Obama’s health law, the administration announced Friday. The milestone indicates nearly a million additional people have signed up since the end of December. It also suggests that the marketplaces are continuing to recover from a disastrous launch on Oct. 1. That still leaves the Obama administration lagging behind its initial projections for overall health law enrollment--but also closer to hitting monthly sign-up expectations it set back in September. The numbers are reassuring for supporters of the Affordable Care Act, who were worried that the pace of sign-ups for private plans would slow in January and February, before picking up again as the March 31 enrollment deadline for 2014 coverage approached. But they are still shy of initial projections from the Centers for Medicare and Medicaid Services, which originally expected 4.4 million people to sign up for a plan by the end of January. Moreover, the administration has not provided data on how many of the people who have signed up for plans through the exchanges have actually made a payment, which is required to ensure coverage.

Medical Billing Blog

Marketplace Enrollment Update: January 2014

Health Insurance in 2014: Lower Premiums but Higher Deductibles

Details are now available on the costs associated with health plans being offered through Healthcare.gov, and some people are finding their insurance will cost more than they had hoped. Until last week, the federal government blocked users from viewing deductible amounts associated with available health plans, limiting consumers to view only premium and copayment amounts. Insurers assumed consumers would pick plans mainly on price, as reflected in the monthly premium, so it was to their advantage, as well as to the government’s, that consumers were unable to view a plan’s annual deductible, or the amount consumers need to pay before coverage kicks in. The federal government finally relented and allowed consumers to basically ‘window shop’ for coverage. For policies offered in the federal exchange, the annual deductible often tops $5,000 for an individual and $10,000 for a couple. The average individual deductible for what is called a bronze plan on the exchange is $5,081 a year, according to a new report on insurance offerings in 34 of the 36 states that are relying on the federally run marketplace. While the costs of these plans are surprising many, they are more generous than what is currently available in the individual market. However, the plans are significantly less generous than what most employers are providing, creating a sticker shock sensation to consumers that are no longer receiving employer-sponsored health insurance.

Healthcare.gov Enrollment Numbers Start to Rise

MBR Explains: Increasing Access - Key Features of the Affordable Care Act by Year -- 2010

Continuing our series on the key features of the Affordable Care Act, we will now look into the changes that took effect in 2010 that sought to increase access to affordable healthcare. As previously mentioned, the Patient Protection and Affordable Care Act was signed by President Obama on March 23, 2010. The law aims to increase the quality and affordability of health insurance, lower the uninsured rate, and reduce the costs of healthcare for individuals and the government. However, a number of the mechanisms – mandates, subsidies, and insurance exchanges – are to be rolled out over four years and beyond. Below is an overview of some of the key provisions aimed to increase access that took effect in 2010.

MBR Explains: Quality Improvements - Key Features of the Affordable Care Act by Year -- 2010

Continuing our series on the key features of the Affordable Care Act, we will now look into the changes that took effect in 2010 that sought to improve quality and lower cost of healthcare. As previously mentioned, the Patient Protection and Affordable Care Act was signed by President Obama on March 23, 2010. The law aims to increase the quality and affordability of health insurance, lower the uninsured rate, and reduce the costs of healthcare for individuals and the government. However, a number of the mechanisms – mandates, subsidies, and insurance exchanges – are to be rolled out over four years and beyond. Below is an overview of some of the key quality improvement provisions that took effect in 2010.

MBR Explains: Coverage - Key Features of the Affordable Care Act by Year -- 2010

MBR Explains: President Obama’s New Plan for Canceled Health Policies

Late morning on Thursday, November, 14th, President Obama proposed a plan to allow insures to extend policies that existed on October 1st to existing customers through the end of 2014. In the majority of cases, these plans are less expensive policies, but offer none of the new essential benefits that are guaranteed under the Patient Protection and Affordable Care Act. Before any cancellation notice was ever sent out, the writers of the PP-ACA included a ‘grandfathered’ clause in the original law. Even though they did not meet the law’s standards, if they were purchased before March 2010 and neither the policy holder nor the insurer made any substantial changes, it was legal for the policy to be sold. On Thursday, the President expanded the net of policies that fall under this clause.

MBR Explains: Why Insurers are Canceling Policies

As members of the Obama administration testify before Congress to the rampant technical problems plaguing healthcare.gov, new criticisms are being thrown at the administration for failing to keep their promise that the Affordable Care Act would not require people to change their health plan if they were happy with their coverage. Reports are circulating on all major news outlets highlighting how individuals are receiving cancelation notices from their insurers, often leaving individuals stunned and upset. No one currently knows how many of the estimated 14 million people who buy their own insurance are getting such notices, but the numbers are substantial. Insurers are reporting discontinuation rates of 20-80% of their individual business. Below is a guide to help you better understand the bigger picture.

The Real Deadline to Sign-Up for the Affordable Care Act

MBR Take-Aways

- If you want your coverage to begin on January 1st, 2014, you must acquire insurance before Dec. 15.

- February 15th, 2014 is the last day you can get coverage and avoid being liable for a penalty.

- Open enrollment period actually will run until the end of Mar. 2014.

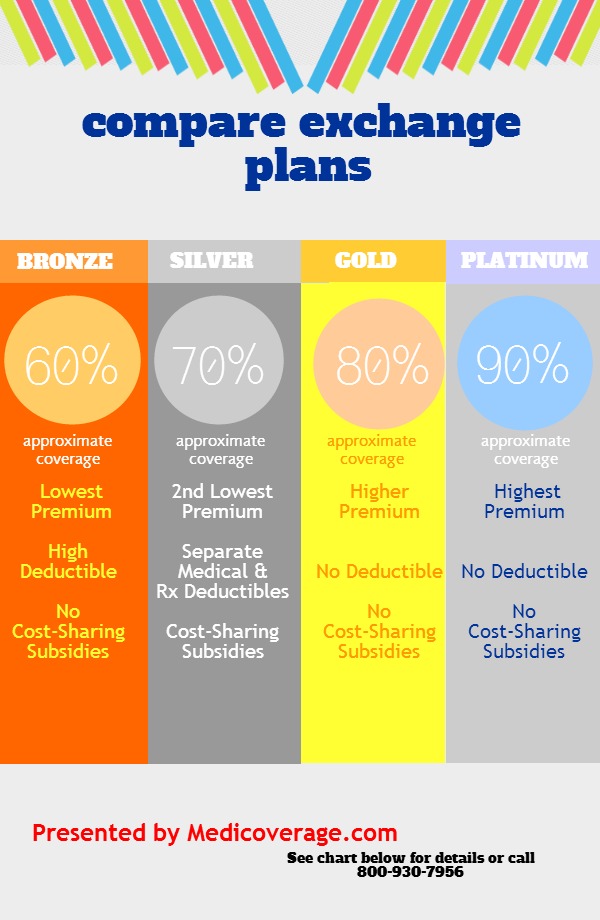

Health Exchange 101: Understanding the Plans

MBR Take-Aways

- There are five different coverage options, all with a different cost structure.

- All plans will include a basic list of benefits.

- The Affordable Care Act does not require coverage for dental, vision, disability, life and critical illness to be listed on the exchange.

There are five different coverage options:

-

Catastrophic plans offer limited physician’s visits, and higher copays, deductibles, and lower monthly payments. Only individuals under the age of 30, or that qualify for the “hardship exemption” are eligible the purchase a catastrophic health plan.

-

Bronze plans will have coinsurance levels of 60%.

-

Silver plans will have coinsurance levels of 70%.

-

Gold plans will have coinsurance levels of 80%.

-

Platinum plans will have coinsurance levels of 90%.

No matter what plan you select, all health plans will provide specific benefits to consumers. A health plan must provide these services to be listed on an exchange. The following is a list of benefits covered by any plan offered:

-

ambulatory patient services

-

emergency services hospitalization

-

maternity and newborn care

-

mental health and substance use disorder services including behavioral health treatment

-

prescription drugs

-

rehabilitative and habilitative services and devices

-

laboratory services

-

preventive and wellness services and chronic disease management

-

pediatric services (including oral and vision care)