With the approaching deadline for enactment of an SGR fix, the similarities to last year’s situation has not been lost on many people when it comes to the possibility that Congress will once again step in to delay the October 1, 2015 effective date for adoption and use of ICD-10 codes.

Medical Billing Blog

As has been previously reported, on April 1, 2014, the Protecting Access to Medicare Act of 2014 was signed into law by President Obama after swift passage by the House and Senate. Language was included in this legislation that prohibited the Secretary of Health and Human Services from mandating use of ICD-10 PRIOR to October 1, 2015.

HHS Set to Announce New ICD-10 Effective Date

As has been previously reported, on April 1, 2014, the Protecting Access to Medicare Act of 2014 was enacted, which specified that the Secretary may not adopt ICD-10 prior to October 1, 2015. This left some uncertainty as to what the new date would be exactly.

There will be no more delays to the October 1 deadline to implement the International Classification of Diseases-10th revision (ICD-10) coding system.

The Real Deadline to Sign-Up for the Affordable Care Act

MBR Take-Aways

- If you want your coverage to begin on January 1st, 2014, you must acquire insurance before Dec. 15.

- February 15th, 2014 is the last day you can get coverage and avoid being liable for a penalty.

- Open enrollment period actually will run until the end of Mar. 2014.

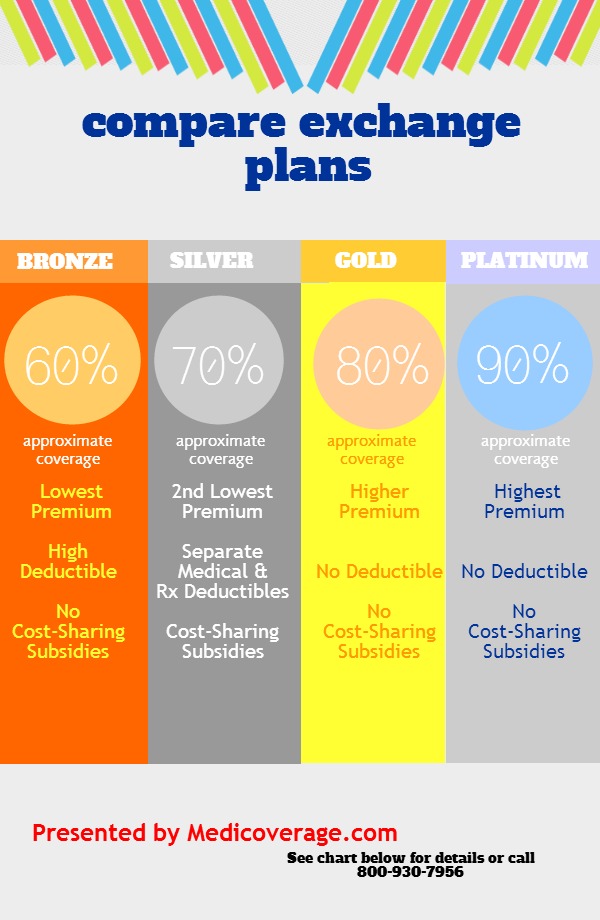

Health Exchange 101: Understanding the Plans

MBR Take-Aways

- There are five different coverage options, all with a different cost structure.

- All plans will include a basic list of benefits.

- The Affordable Care Act does not require coverage for dental, vision, disability, life and critical illness to be listed on the exchange.

There are five different coverage options:

-

Catastrophic plans offer limited physician’s visits, and higher copays, deductibles, and lower monthly payments. Only individuals under the age of 30, or that qualify for the “hardship exemption” are eligible the purchase a catastrophic health plan.

-

Bronze plans will have coinsurance levels of 60%.

-

Silver plans will have coinsurance levels of 70%.

-

Gold plans will have coinsurance levels of 80%.

-

Platinum plans will have coinsurance levels of 90%.

No matter what plan you select, all health plans will provide specific benefits to consumers. A health plan must provide these services to be listed on an exchange. The following is a list of benefits covered by any plan offered:

-

ambulatory patient services

-

emergency services hospitalization

-

maternity and newborn care

-

mental health and substance use disorder services including behavioral health treatment

-

prescription drugs

-

rehabilitative and habilitative services and devices

-

laboratory services

-

preventive and wellness services and chronic disease management

-

pediatric services (including oral and vision care)

Obama Administration Releases Premium Costs of Health Plan

MBR Take-Aways

- The “silver plan” will cost an average of $328 a month for individuals across the US

- Prices were lower in states with more competition among insurers and higher in states with fewer players

- The Obama administration is counting on signing up 7 million Americans in the first full year of reform

On Tuesday, the Obama Administration released the first detailed look at premiums to be charged to consumers for health insurance bought on the new insurance markets mandated by the 2010 Patient Protection and Affordable Care Act. Information released on Tuesday is based on approved insurance plans in the 36 states where the federal government will operate the insurance exchange.