Continuing our series on the key features of the Affordable Care Act, we will now look into the changes that took effect in 2010 that sought to improve quality and lower cost of healthcare. As previously mentioned, the Patient Protection and Affordable Care Act was signed by President Obama on March 23, 2010. The law aims to increase the quality and affordability of health insurance, lower the uninsured rate, and reduce the costs of healthcare for individuals and the government. However, a number of the mechanisms – mandates, subsidies, and insurance exchanges – are to be rolled out over four years and beyond. Below is an overview of some of the key quality improvement provisions that took effect in 2010.

Improving Quality and Lowering Costs

- The ACA helps small businesses afford the cost of covering their employees by providing a health insurance tax credit. There are three requirements an eligible small employer must meet: you have fewer than 25 employees (calculated by full-time equivalent units), you paid average annual wages for the tax year of less than $50,000 per FTE, and you paid premiums for employee health insurance coverage under a qualifying arrangement. If your business meets these requirements, it may qualify for a tax credit of up to 35% to offset the cost of your insurance.

The definition of a qualifying arrangement generally requires you to pay a uniform percentage (not less than 50%) of the premium cost for each enrolled employee’s health insurance coverage. The uniformity requirement under the qualifying arrangement states that you must pay the same percentage (or amount) for each of your employees enrolled in coverage.

You must use the Credit for Small Employer Health Insurance Premiums, or Form 8941, to calculate the credit. The form can be found at http://www.irs.gov/pub/irs-pdf/f8941.pdf.

**I have personally gone through the process for this company. Unfortunately, the calculations were tedious, confusing, and very time consuming. It resulted in a significantly lower tax credit than advertised.

- All new health insurance plans that became effective on or after September 23, 2010, must cover certain preventive services without charging a deductible, co-pay or coinsurance. Please check tomorrow’s post on the complete list of covered services for adults, women and children.

- The ACA created the Prevention and Public Health Fund, a $15 billion program that will invest in proven prevention and public health programs in order to help keep Americans healthy. Over 75% of theUnited States’ total health spending is contributed to chronic diseases such as heart disease, cancer, stroke and diabetes. These diseases are responsible for 7 out of 10 deaths among Americans each year. The federal government is working with states and communities to help control these diseases and illnesses before they happen. Since the Affordable Care Act was passed in 2010, the Department of Health and Human Services has awardedMichiganand organizations inMichiganmore than $22.8 million.

- Healthcare fraud is a serious issue that has taken billions of dollars out of the Medicare Trust Fund. The new health law invests new resources and requires new screening procedures for health care providers to reduce waste in Medicare, Medicaid and CHIP. Some of the new tools HHS and DOJ have available include: increased sentencing guidelines for healthcare fraud by 20-50% for crimes with over $1 million in losses, state of the art technology that uses advanced predictive modeling, and enhanced screening for providers and suppliers who may pose a higher risk of fraud or abuse. Since 2010, the government has recovered over $10.7 billion dollars, a record amount.

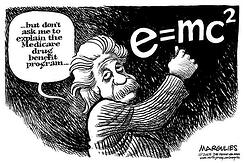

- Medicare prescription drug coverage (Part D) is now more affordable due to a provision in the ACA that gradually closes the gap in coverage, commonly known as the “donut hole.” This gap lies between the initial coverage and the catastrophic coverage threshold. After a Medicare beneficiary exits the initial coverage of their plan, the beneficiary is financially responsible for a higher cost of prescription drugs until he or she reaches the catastrophic coverage threshold. With the passage of the ACA, people who fall within the donut hole will receive a $250 rebate within three months of reaching the coverage gap. In addition, beneficiaries will receive a 7% discount on generic drugs while in the donut hole, with increasing discounts year after year until 2020, when the donut hole gap will be closed.

Additional information can be found at the U.S. Department of Health and Human Services website: www.hhs.gov/healthcare