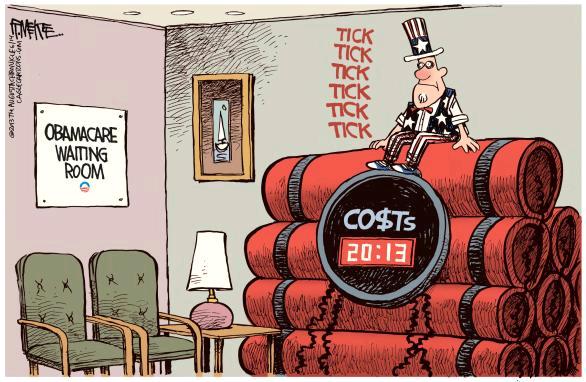

Obamacare is about to collide with the U.S. tax-filing season, adding frustration for millions of taxpayers trying to figure out how to comply and how much they will owe the government.

Medical Billing Blog

Affordable Care Act: 10 Million Newly Insured

About 10.3 million Americans have gained insurance coverage since the full implementation of Obamacare last year, according to an analysis published Wednesday in the New England Journal of Medicine. The study, done by Harvard researchers and published by the NEJM, was based on Gallup polling and data from the Department of Health and Human Services. It also estimated that the uninsured rate declined by 5.2 percentage points in the second quarter of 2014, or from 21 percent in September 2013 to 16.3 percent in April 2014. In particular, it found jumps in the insurance rates for Hispanics, blacks and young adults.

In its latest April 2014 report on the Affordable Care Act (ACA), the Congressional Budget Office (CBO) announced that it is no longer possible to project the overall fiscal impact of the health care law.

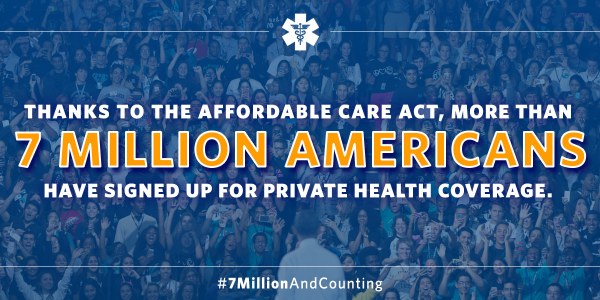

March 23rd marked the four-year anniversary of enactment of the Affordable Care Act (ACA). Most of the past four years have been spent developing the infrastructure and refining the policies to implement the law. Implementation began on October 1st, 2013, when the first open enrollment period went live. Now, as the first open enrollment period comes to an end, it seems like an appropriate opportunity to examine the state of the ACA as “phase one” comes to an end.

President Barack Obama celebrated the end of the Affordable Care Act’s first open enrollment period by announcing that at least 7.1 million Americans have signed up for insurance through exchanges. "No, the Affordable Care Act hasn’t fixed our long broken health care system, but this law has made our broken system a lot better," Obama said before a large and happy crowd Tuesday afternoon in the Rose Garden. The tally is based on the number of people who enrolled for coverage by Monday’s deadline through the new federal insurance marketplace operating in three dozen states. It also includes people who enrolled in 14 state-run marketplaces as of the deadline or, in the case of a few states, by last weekend. The Census Bureau estimates that 47 million Americans went without health insurance last year, more than 15 percent of the population. White House press secretary Jay Carney said Tuesday that the administration expects that the final numbers will also show sharply higher enrollment by young adults, though demographic breakdowns by race or age will not be available for days or weeks, and he was unable to say how many of the enrollees were previously uninsured. The law’s impact on the uninsured, he said, was intended to be measured over three years.

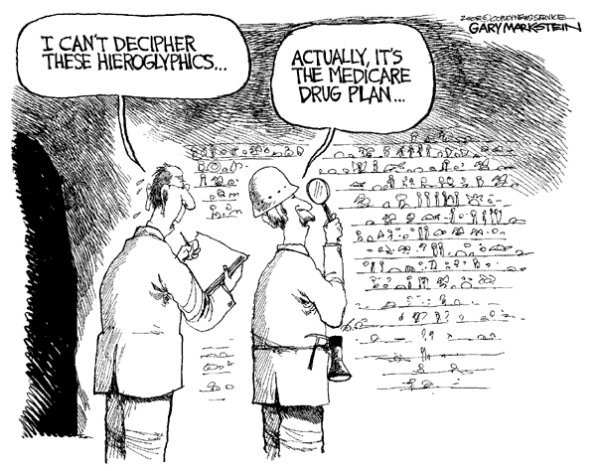

Proposed Medicare Part D Changes Are Postponed

The Obama administration has dropped plans to change the Medicare prescription drug program amid criticism from industry, patient advocacy groups and lawmakers that the changes would limit seniors’ access to certain medications and choice of plans. CMS Administrator Marilyn Tavenner wrote in a letter to Congress Monday that she was shelving changes proposed in January that could have loosened the requirements that Medicare Part D insurance plans cover a broad range of drugs in six “protected classes” of medications. Since the start of Medicare’s prescription drug benefit in 2006, the government has required insurers to cover “all or substantially all” drugs in six treatment areas. The administration proposed in January to lift the requirement for three types of medications: immunosuppressant drugs used in transplant patients; antidepressants; and antipsychotic medicines, used to treat schizophrenia and certain related disorders. Medicare officials had said the proposal would have saved money and reduced the overuse of drugs.

Obama Administration Delays Part Of Employer Mandate Again

The Obama administration announced Monday it would give medium-sized employers an extra year, until 2016, before they must offer health insurance to their full-time workers. Firms with at least 100 employees will have to start offering this coverage in 2015. Small businesses with fewer than 50 workers have always been exempt from the new coverage requirements but the law originally required all other businesses to start covering their workers for face penalties beginning Jan. 1, 2014. Under the Affordable Care Act, larger employers are generally subject to tax penalties if they fail to offer "minimum essential coverage" to full-time employees and their dependents. The administration laid out a three-tier approach. For larger employers with 100 or more employees (about 2 percent of employers): Seventy percent of employees must be offered coverage in 2015, and in later years at least 95 percent of employees must be offer coverage. Employers that do not meet these standards will be subject to tax penalties. For employers with 50 to 99 employees (about 2 percent of employers): Companies with 50 to 99 employees will have an extra year, until 2016, to provide coverage or pay tax penalties. For small businesses with fewer than 50 employees (about 96 percent of all employers): These companies will not be required to provide coverage or fill out any forms in any year. Officials Monday said that the delay in the Affordable Care Act mandate will affect 50 percent of the businesses that were supposed to be complying by 2015. About 7.8 million workers are employed by the affected businesses. However, those officials also took pains to note that the so-called employer mandate to offer affordable health insurance to workers does not affect 96 percent of the employers in the U.S., because they have fewer than 50 full-time employees.

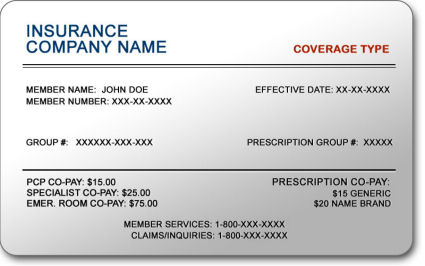

Verifying Patient Coverage in a Health Insurance Marketplace Plan

Beginning January 1, 2014, providers will be verifying their patient’s insurance status when they show up for their appointments. Many of these patients may be newly insured individuals who will be getting their health insurance through the Health Insurance Marketplace, also known as Health Insurance Exchange.

MBR Explains: Quality Improvements - Key Features of the ACA by Year -- 2011

Continuing our series on the key features of the Affordable Care Act, we will now look into the changes that took effect in 2011 that sought to improve quality and lower cost of healthcare. The majority of these changes effected seniors enrolled in Medicare. The ACA aims to increase the quality and affordability of health insurance, lower the uninsured rate, and reduce the costs of healthcare for individuals and the government. However, a number of the mechanisms – mandates, subsidies, and insurance exchanges – are to be rolled out over four years and beyond. Below is an overview of some of the key quality improvement provisions that took effect in 2011.

Health Insurance in 2014: Lower Premiums but Higher Deductibles

Details are now available on the costs associated with health plans being offered through Healthcare.gov, and some people are finding their insurance will cost more than they had hoped. Until last week, the federal government blocked users from viewing deductible amounts associated with available health plans, limiting consumers to view only premium and copayment amounts. Insurers assumed consumers would pick plans mainly on price, as reflected in the monthly premium, so it was to their advantage, as well as to the government’s, that consumers were unable to view a plan’s annual deductible, or the amount consumers need to pay before coverage kicks in. The federal government finally relented and allowed consumers to basically ‘window shop’ for coverage. For policies offered in the federal exchange, the annual deductible often tops $5,000 for an individual and $10,000 for a couple. The average individual deductible for what is called a bronze plan on the exchange is $5,081 a year, according to a new report on insurance offerings in 34 of the 36 states that are relying on the federally run marketplace. While the costs of these plans are surprising many, they are more generous than what is currently available in the individual market. However, the plans are significantly less generous than what most employers are providing, creating a sticker shock sensation to consumers that are no longer receiving employer-sponsored health insurance.