If you offer it, will they come? Insurers and some U.S. senators have proposed offering cheaper, skimpier "copper" plans on the health insurance marketplaces to encourage uninsured stragglers to buy. But consumer advocates and some policy experts say that focusing on reducing costs on the front end exposes consumers to unacceptably high out-of-pocket costs if they get sick. The trade-off, they say, may not be worth it.

Medical Billing Blog

Skimpier 'Copper' Plans Might be Coming to Healthcare.gov

HHS Report Details ACA Premium Subsidy Use And Cost

Federal officials on Wednesday released new data about who enrolled in the federal health marketplace plans for 2014, how much the law’s subsidies helped offset the cost and how many plans people from could choose from, among other details.

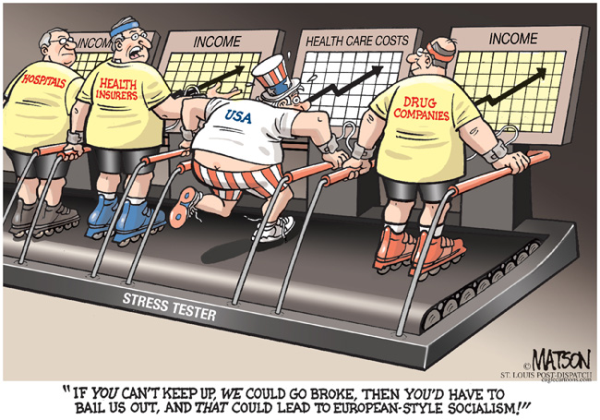

Health care spending rose at the fastest pace since 1980 as the new health insurance law prompted many more Americans to seek medical treatment. “Following several years of decline, 2013 was striking for the increased use by patients of all parts of the U.S. health care system,” Murray Aitken, executive director of the IMS Institute for Healthcare Informatics, said in a statement. Health care expenditures climbed at a 9.9% annual rate last quarter, mostly because of increased spending at hospitals, the Bureau of Economic Analysis said last week. That's the biggest jump since 1980's third quarter, and it followed a 5.6% increase in the fourth quarter of 2013.

CBO Projects Health Law Subsidies Will Cost Less than Expected

Health-insurance premiums for plans sold in the Affordable Care Act's exchanges will be lower than previously expected for the next few years, according to a report by the Congressional Budget Office released Monday. The Congressional Budget Office predicts that health insurance subsidies under the Affordable Care Act will total a little more than $1 trillion over the next 10 years, instead of almost $1.2 trillion initially estimated. CBO said the 8 percent cut results largely from tighter cost controls by insurance companies offering plans on health care exchanges. Generally speaking, the plans offered on the exchanges pay health care providers less and have tighter management of patients’ treatment options, and that means lower premiums and taxpayer subsidies.