According to study by the Kaiser Family Foundation analyzing ACA Benchmark premiums in the largest cities from 15 states and the District of Columbia, there will be a mixture of premium increases and premium decreases for the benchmark Silver plans in 2015. While many of the Silver plans sold on the Exchanges in 2014 will charge higher premiums in 2015, the new plans being sold on these Exchanges will have prices below (in some cases well below) the prices for the returning plans.

Medical Billing Blog

Some Premiums up, some Premiums down for 2015 Healthcare.gov

Who Shopped The SHOP Exchanges? Very Few Small Businesses

Monteith Illingworth and Chris Abbate both have small public relations firms in Manhattan. Both offer their employees health coverage through Oxford Health, a division of insurance giant United Healthcare. Both faced double-digit premium hikes last year. And both considered hitting the eject button to buy coverage from the New York State of Health, the new insurance marketplace set up under the Affordable Care Act.

Survey: Most Buying On Insurance Exchanges Were Uninsured

Nearly six in 10 Americans who bought insurance for this year through the health law’s online marketplaces were previously uninsured—most for at least two years, according to a new survey that looks at the experiences of those most affected by the law.

CMS Issues Final Version of 2015 Health Exchange Rule

Earlier this month, CMS released the final version of the Exchange and Insurance Market Standards for 2015. This final rule outlines how the healthcare market places will function in 2015. The rule finalizes policies regarding consumer notices, quality reporting and enrollee satisfaction surveys, the Small Business Health Options Program (SHOP), standards for Navigators and other consumer assisters, and policies regarding the premium stabilization programs, among other standards.

March 23rd marked the four-year anniversary of enactment of the Affordable Care Act (ACA). Most of the past four years have been spent developing the infrastructure and refining the policies to implement the law. Implementation began on October 1st, 2013, when the first open enrollment period went live. Now, as the first open enrollment period comes to an end, it seems like an appropriate opportunity to examine the state of the ACA as “phase one” comes to an end.

Kathleen Sebelius, the secretary of health and human services, said Wednesday that the Obama administration would not extend the deadline for people to sign up for health insurance or delay the requirement for most Americans to have coverage. There will also be no delay in the penalty most Americans face under President Barack Obama's healthcare reform law if they fail to obtain health coverage this year. Last year, embracing nonpartisan estimates for the Affordable Care Act, Health and Human Services Secretary Kathleen Sebelius set a benchmark for the new insurance marketplaces: "Success looks like at least 7 million people having signed up by the end of March 2014," she said to NBC. Enrollment, however, began at a terribly slow pace in October because of all the technical problems with HealthCare.gov, the federal health exchange website serving 36 states. Some state-run health exchange websites have had their own problems as well. Within that context, Sebelius on Wednesday redefined what success looks like: "Success looks like millions of people with affordable health coverage, which we will have by the end of March," she told the House Ways and Means Committee. The administration released the latest enrollment figures on Tuesday—revealing that some 4.2 million Americans have signed up for coverage on the new exchanges. However, that figure does not include how many people have actually paid for their plans—a metric that could make the actual number of enrollees significantly lower.

Obama Administration Unveils New Affordable Care Act Changes… again.

The Obama administration announced Wednesday that it has rewritten an array of far-reaching rules under the Affordable Care Act, the most significant of which will let people keep bare-bones health insurance policies for three more years. Americans with health insurance policies that don't meet consumer standards set by the president's healthcare law would be allowed to keep their plans into 2017, three years later than originally envisioned, so that people can buy these noncompliant plans through October 2016 and be covered by them until the following September, when Obama’s tenure in the White House will have ended. The healthcare law was designed to phase out health insurance plans in 2014 if they did not include a basic set of benefits and limits on how much consumers can be required to pay out of pocket for their medical care. After the controversy broke, the administration announced in November that state regulators could allow insurers to renew old policies in 2014. Only about half the states have agreed to the extensions. Some, particularly those with liberal, Democratic insurance regulators, have balked at allowing what they consider substandard plans to remain on the market.

Healthcare.gov's Payment System Months from Completion

The federal government may not completely finish the automated payment system for Healthcare.gov for “several months,” White House spokesman Jay Carney said Friday. Until that system is fully running, the administration won’t be able to verify how many of the consumers who signed up for through the health insurance website are, in fact, paying their premiums and are hence truly enrolled. The administration reported earlier in the week that nearly 3.3 million people have selected plans on through the marketplace as of Feb. 1. However, insurance companies are saying that about 20 percent of those people failed to pay their premiums on time and consequently didn’t receive coverage in January, the New York Times reports. Paying the first month’s premium is the final step in completing an enrollment. Under federal rules, people must pay the initial premium to have coverage take effect. In view of the chaotic debut of the federal marketplace and many state exchanges, the White House urged insurers to give people more time, and many agreed to do so. But, insurers said, some people missed even the extended deadlines.

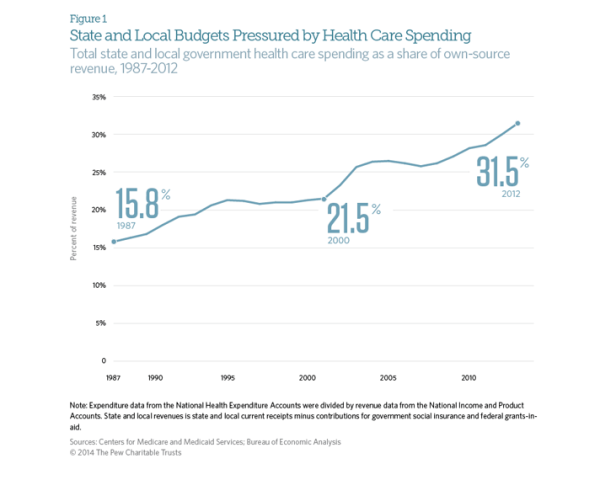

State and Local Governments Spend 31.5% on Healthcare

The Affordable Care Act was supposed to stem the rapidly rising cost of healthcare in the United States. While costs have continued to rise since the ACA’s passage in 2010, the rate has slowed dramatically. Early indicators suggest that the growth rate of total healthcare spending in the US was only 4% in 2012. This is an improvement when looking at the aggregate expenditures, unfortunately, for state and local governments, the cost curve has not had any form of reduction. According to CMS and the Bureau of Economic Analysis, state and local governments spent 31.5% of their budgets on healthcare costs in 2012. That represents an 8 percent increase over the previous year, or a rate twice as fast as the national rate of increase. This increase is largely due in part to the stimulus bill passed by Congress in 2009. The American recovery and Reinvestment Act granted more than $100 billion to states to cover increasing Medicaid costs, which had ballooned during the recession as high unemployment drove job-seekers to the government run health program. During this period, even though Medicaid saw increased participants, overall state spending on Mediciad actually fell. However, the federal stimulus money would not last forever and State Mediciad expenditures rose 22 percent between 2010 and 2011, and another 15 percent in 2012. The Government Accountability Office says health-care spending represents the single greatest threat to state and local government long-term health.

City of Detroit and Retirees Reach Agreement on Health Insurance

The city of Detroit and its retirees have reached an agreement in a health insurance dispute that may end a lawsuit against the city. Retirees filed suit in November to stop the city from shifting them to Medicare and giving those under age 65 a $125 monthly stipend to buy their own insurance. The parties reached an agreement in principle Thursday night covering benefits through the end of 2014, mediators in Detroit's bankruptcy said Friday in a statement. Some features of the deal include the increase to $300 in the monthly stipend for retirees over age 65 who aren't eligible for Medicare. The stipend for retirees under age 65 will be increased to $175 if the household income is less than $75,000 and the retiree acquires insurance under a health care exchange. The stipend is $50 more than the amount proposed last year by emergency manager Kevyn Orr. A lawsuit retiree groups filed in bankruptcy court Jan. 9 challenging the city’s plan to slash benefits will be dismissed as a result of the settlement, according to a statement from the Detroit bankruptcy court mediators.