Fall is enrollment season for many people who get insurance through their workplace. Premium increases for 2015 plans are expected to be modest on average, but the shift toward higher out-of-pocket costs overall for consumers will continue as employers try to keep a lid on their costs and incorporate health law changes.

Medical Billing Blog

Modest Premium Hikes, Higher Consumer Costs Likely For Job-Based Plans

DOL Issues Final Rule on Worker Eligibility for Health Insurance

The U.S. Department of Labor has issued a final rule that prohibits employers from requiring employees to wait more than 90 days after being hired before they can be covered by the Company’s sponsored health insurance plan.

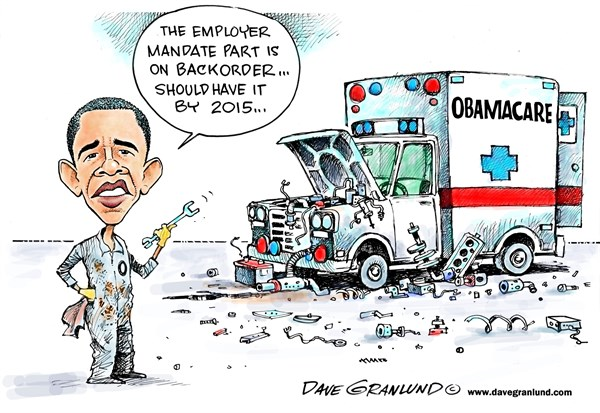

Obama Administration Delays Part Of Employer Mandate Again

The Obama administration announced Monday it would give medium-sized employers an extra year, until 2016, before they must offer health insurance to their full-time workers. Firms with at least 100 employees will have to start offering this coverage in 2015. Small businesses with fewer than 50 workers have always been exempt from the new coverage requirements but the law originally required all other businesses to start covering their workers for face penalties beginning Jan. 1, 2014. Under the Affordable Care Act, larger employers are generally subject to tax penalties if they fail to offer "minimum essential coverage" to full-time employees and their dependents. The administration laid out a three-tier approach. For larger employers with 100 or more employees (about 2 percent of employers): Seventy percent of employees must be offered coverage in 2015, and in later years at least 95 percent of employees must be offer coverage. Employers that do not meet these standards will be subject to tax penalties. For employers with 50 to 99 employees (about 2 percent of employers): Companies with 50 to 99 employees will have an extra year, until 2016, to provide coverage or pay tax penalties. For small businesses with fewer than 50 employees (about 96 percent of all employers): These companies will not be required to provide coverage or fill out any forms in any year. Officials Monday said that the delay in the Affordable Care Act mandate will affect 50 percent of the businesses that were supposed to be complying by 2015. About 7.8 million workers are employed by the affected businesses. However, those officials also took pains to note that the so-called employer mandate to offer affordable health insurance to workers does not affect 96 percent of the employers in the U.S., because they have fewer than 50 full-time employees.