According to study by the Kaiser Family Foundation analyzing ACA Benchmark premiums in the largest cities from 15 states and the District of Columbia, there will be a mixture of premium increases and premium decreases for the benchmark Silver plans in 2015. While many of the Silver plans sold on the Exchanges in 2014 will charge higher premiums in 2015, the new plans being sold on these Exchanges will have prices below (in some cases well below) the prices for the returning plans.

Medical Billing Blog

Some Premiums up, some Premiums down for 2015 Healthcare.gov

Health Insurance in 2014: Lower Premiums but Higher Deductibles

Details are now available on the costs associated with health plans being offered through Healthcare.gov, and some people are finding their insurance will cost more than they had hoped. Until last week, the federal government blocked users from viewing deductible amounts associated with available health plans, limiting consumers to view only premium and copayment amounts. Insurers assumed consumers would pick plans mainly on price, as reflected in the monthly premium, so it was to their advantage, as well as to the government’s, that consumers were unable to view a plan’s annual deductible, or the amount consumers need to pay before coverage kicks in. The federal government finally relented and allowed consumers to basically ‘window shop’ for coverage. For policies offered in the federal exchange, the annual deductible often tops $5,000 for an individual and $10,000 for a couple. The average individual deductible for what is called a bronze plan on the exchange is $5,081 a year, according to a new report on insurance offerings in 34 of the 36 states that are relying on the federally run marketplace. While the costs of these plans are surprising many, they are more generous than what is currently available in the individual market. However, the plans are significantly less generous than what most employers are providing, creating a sticker shock sensation to consumers that are no longer receiving employer-sponsored health insurance.

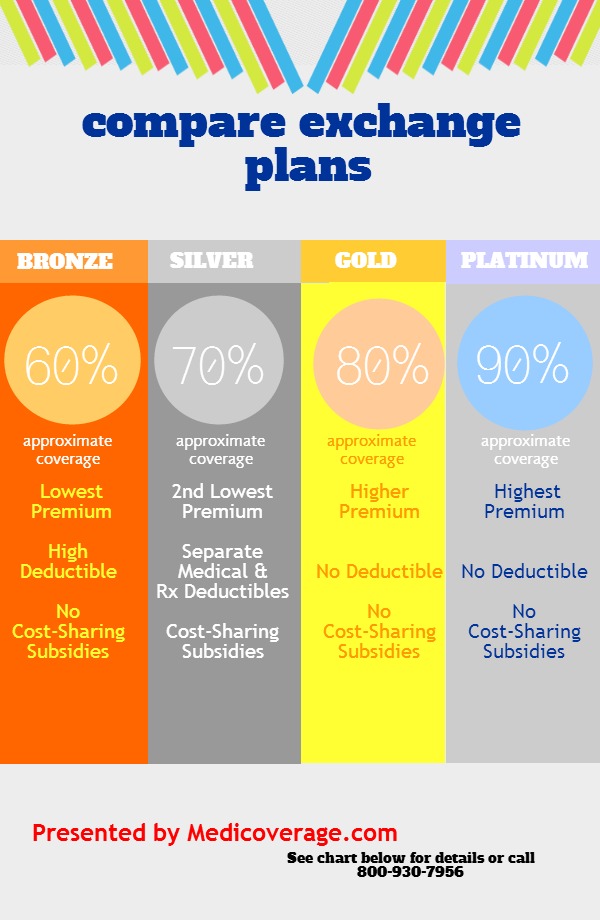

Health Exchange 101: Understanding the Plans

MBR Take-Aways

- There are five different coverage options, all with a different cost structure.

- All plans will include a basic list of benefits.

- The Affordable Care Act does not require coverage for dental, vision, disability, life and critical illness to be listed on the exchange.

There are five different coverage options:

-

Catastrophic plans offer limited physician’s visits, and higher copays, deductibles, and lower monthly payments. Only individuals under the age of 30, or that qualify for the “hardship exemption” are eligible the purchase a catastrophic health plan.

-

Bronze plans will have coinsurance levels of 60%.

-

Silver plans will have coinsurance levels of 70%.

-

Gold plans will have coinsurance levels of 80%.

-

Platinum plans will have coinsurance levels of 90%.

No matter what plan you select, all health plans will provide specific benefits to consumers. A health plan must provide these services to be listed on an exchange. The following is a list of benefits covered by any plan offered:

-

ambulatory patient services

-

emergency services hospitalization

-

maternity and newborn care

-

mental health and substance use disorder services including behavioral health treatment

-

prescription drugs

-

rehabilitative and habilitative services and devices

-

laboratory services

-

preventive and wellness services and chronic disease management

-

pediatric services (including oral and vision care)