The Medicare Sustainable Growth Rate (SGR) is the current method used by the Centers for Medicare and Medicaid Services (CMS) to control spending by Medicare on physician services, through ensuring that the yearly increase in the expense per Medicare beneficiary does not exceed the growth in GDP. It was introduced in 1997 as part of the Balanced Budget Act of 1997. And, for the first couple years, it worked relatively well. That is because Medicare expenditures in those years did not exceed the target amount, allowing doctors to receive modest pay increases. But in 2002, the situation changed. Medicare expenditures exceeded the target expenditures set in the previous year, so Congress was required by statute to balance payments to match the target SGR. Doctors across the nation reacted with contempt as Congress attempted to enact a 4.8% pay cut. Congress eventually relented and passed stopgap legislation to prevent the scheduled cut, thereby temporarily suspending the reduction for a matter of weeks. Weeks then turned into months and months into years, and now physicians face a 26.5% cut under the SGR. Virtually no one believes Congress will allow the SGR to lower pay by such an amount, but doctors have sent a strong message to lawmakers that the annual ritual of enacting a last minute, transitory solution that only defers the increase to a later date needs to stop.

Medical Billing Blog

Scott Shatzman

Recent Posts

MBR Explains: Why Insurers are Canceling Policies

As members of the Obama administration testify before Congress to the rampant technical problems plaguing healthcare.gov, new criticisms are being thrown at the administration for failing to keep their promise that the Affordable Care Act would not require people to change their health plan if they were happy with their coverage. Reports are circulating on all major news outlets highlighting how individuals are receiving cancelation notices from their insurers, often leaving individuals stunned and upset. No one currently knows how many of the estimated 14 million people who buy their own insurance are getting such notices, but the numbers are substantial. Insurers are reporting discontinuation rates of 20-80% of their individual business. Below is a guide to help you better understand the bigger picture.

Comparing Healthcare Spending Across Nations

As a country, the United States spend more per capita on health care than any other OECD (Organization for Economic Co-operation and Development) country. We have one of the highest growth rates in health care spending in the world. The share of the economy devoted to healthcare increased from 7.2% in 1970 to 17.9% in 2009 and 2010. However, the Patient Protection and Affordable Care Act, along with a weak economy, has slowed down healthcare spending to historic lows in recent years. We are innovating new ways to reduce costs, improve health, and distangle the healthcare bureaucracy daily. But more needs to be done. Thanks to the people at www.humanresourcesmba.net, we have our healthcare spending story in an easy to follow infographic. Compare how we spend our healthcare funds against other countries while exploring all of the new incentives companies are taking to improve wellness for our working citizenry.

Improve Cash Flow through a Lockbox Service

MBR Key-Takeaways

1. When using a lockbox, the entire deposit transaction takes place in one day, meaning your practice gets its money into its account much faster.

MBR Explains: The Affordable Care Act’s Reinsurance Tax

During the government shutdown, there was a lot of talk about the Affordable Care Act, specifically the Act’s Reinsurance Tax, which would provide relief to insurers which cover large numbers of high-cost medical cases. In their proposal to open the government, members of the Senate included a one year delay in the tax's implementation. Even though the federal government opened last week, both houses are still negotiating the fine details of their compromise. While we all wait for Congress, MBR explains what the Reinsurance tax is.

The Real Deadline to Sign-Up for the Affordable Care Act

MBR Take-Aways

- If you want your coverage to begin on January 1st, 2014, you must acquire insurance before Dec. 15.

- February 15th, 2014 is the last day you can get coverage and avoid being liable for a penalty.

- Open enrollment period actually will run until the end of Mar. 2014.

MBR Take-Aways

- It’s especially important that all administrative and clinical staff receive ICD-10 training. Some staff, like physicians and coders, will require more in-depth training of the new code set.

- There are many different training options – classroom style, online courses, webinar, self-taught. Finding the correct mix of training options is important to increase overall understanding, while keeping the overall costs manageable.

- Don’t forget to calculate biller/coder/physician down time while they are in training.

This time next year, new coding changes from ICD-10 will be in its first couple weeks of implementation. While this substantial revision to the international classification of diseases is certain to create uncertainty among billers, physicians, and payers, it will also create an opportunity to develop new competencies and skills. Preparation is key to maximize your results, and it starts with your medical staff. CMS recommended steps for small to medium practices to follow to make the transition and training process go more smoothly. Developing a plan for the changeover to ICD-10 coding must be done only after a comprehensive assessment of your staff’s needs.

MBR Take-Aways

- HHS has met its 2013 goal of EHR implementation.

- Over half of all eligible providers and over eighty percent of hospitals use EHRs.

- More than 291,000 EPs and more than 3,800 eligible hospitals received incentive payments from the federal government.

Health and Human Services (HHS) Secretary Kathleen Sebelius announced that HHS has already met and exceeded its 2013 goal of EHR implementation. With significant incentives from the federal government, more than half of all eligible providers (EPs) and over eighty percent of eligible hospitals nationwide are demonstrating meaningful use of electronic medical records (EHRs). This is a considerable increase in just five years. According to a 2012 Centers for Disease Control and Prevention survey, the percent of physicians using an advanced EHR system was pegged at 17 percent in 2008, while hospitals, only just 9 percent had adopted the technology. In a statement, Secretary Sebelius said, “We have reached a tipping point in adoption of electronic health records. Health IT helps providers better coordinate care, which can improve patients’ health and save money at the same time.” Electronic medical records play a vital role in President Obama’s signature healthcare law, the Affordable Care Act. Powerful incentives were made available for EPs to offset some of the initial costs. More than fifty percent of eligible physicians have capitalized by taking advantage of this subsidy. Some of the broader goals of the ACA are to improve care coordination, reduce duplicative tests and procedures, and reward hospitals and physicians for keeping patients healthier, all of which are supported by widespread use of EHRs.

Effect of a Government Shutdown on Medicare

MBR Take-Aways

- Funding for Medicare and Medicaid is mandatory, meaning it is not subject to annual appropriations that lapse during a shutdown.

- A government shutdown could result in delays in claims processing, audits, and other administrative functions at CMS.

- During the 1995-1996 government shutdown, Medicare continued to pay physicians and hospitals according to prevailing payment rates, since claims are made out of the Medicare trusts and not current appropriations.

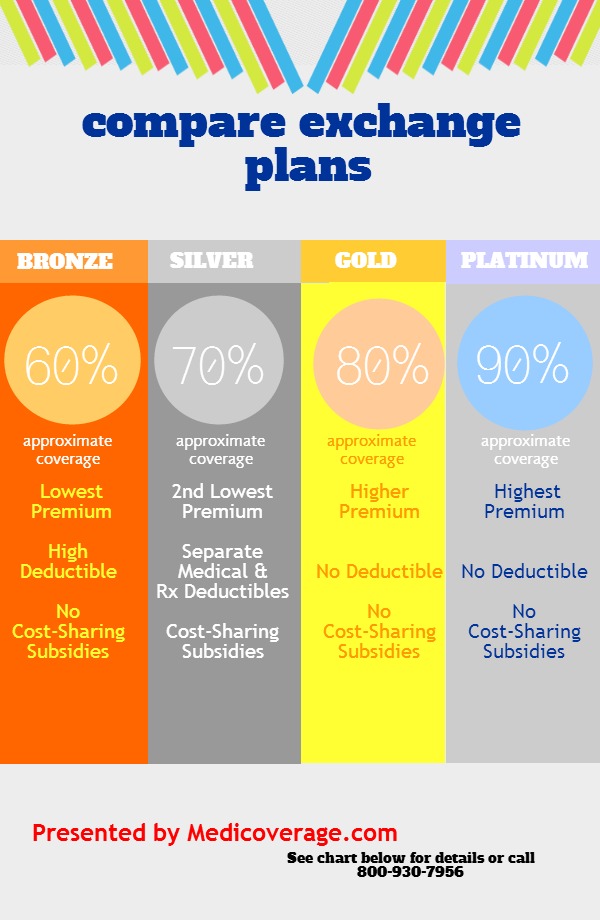

Health Exchange 101: Understanding the Plans

MBR Take-Aways

- There are five different coverage options, all with a different cost structure.

- All plans will include a basic list of benefits.

- The Affordable Care Act does not require coverage for dental, vision, disability, life and critical illness to be listed on the exchange.

There are five different coverage options:

-

Catastrophic plans offer limited physician’s visits, and higher copays, deductibles, and lower monthly payments. Only individuals under the age of 30, or that qualify for the “hardship exemption” are eligible the purchase a catastrophic health plan.

-

Bronze plans will have coinsurance levels of 60%.

-

Silver plans will have coinsurance levels of 70%.

-

Gold plans will have coinsurance levels of 80%.

-

Platinum plans will have coinsurance levels of 90%.

No matter what plan you select, all health plans will provide specific benefits to consumers. A health plan must provide these services to be listed on an exchange. The following is a list of benefits covered by any plan offered:

-

ambulatory patient services

-

emergency services hospitalization

-

maternity and newborn care

-

mental health and substance use disorder services including behavioral health treatment

-

prescription drugs

-

rehabilitative and habilitative services and devices

-

laboratory services

-

preventive and wellness services and chronic disease management

-

pediatric services (including oral and vision care)