MBR Take-Aways

- There are five different coverage options, all with a different cost structure.

- All plans will include a basic list of benefits.

- The Affordable Care Act does not require coverage for dental, vision, disability, life and critical illness to be listed on the exchange.

On October 1

st, all across the country, health exchanges will open for individuals, families and businesses to compare and purchase health coverage, as mandated by the Affordable Care Act. These exchanges are a key component to reducing overall healthcare costs.

However, most health care consumers may not be familiar with the differences in coverage options, and why an exchange plan may or may not be right for them. We have attempted to break down the five different coverage options below so you can have a better understanding for when the exchange opens next week.

There are five different coverage options:

-

Catastrophic plans offer limited physician’s visits, and higher copays, deductibles, and lower monthly payments. Only individuals under the age of 30, or that qualify for the “hardship exemption” are eligible the purchase a catastrophic health plan.

-

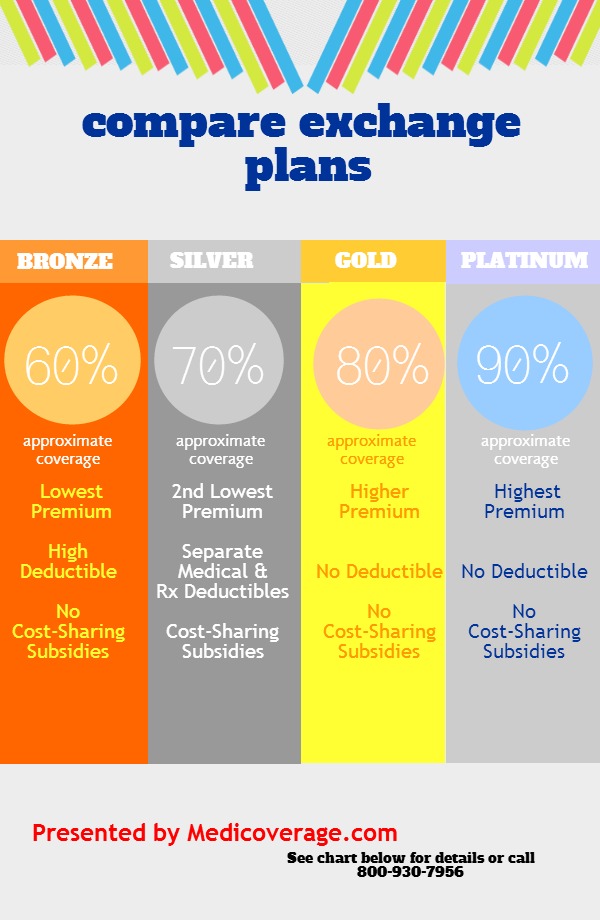

Bronze plans will have coinsurance levels of 60%.

-

Silver plans will have coinsurance levels of 70%.

-

Gold plans will have coinsurance levels of 80%.

-

Platinum plans will have coinsurance levels of 90%.

Copays, deductibles and co-insurance will be highest for consumers enrolled in a “bronze” level plan. However, these enrollees will pay the lowest monthly premiums among all five coverage options. The highest monthly premiums will be through platinum plans, but enrollees will pay lower out of pocket expenses, such as reduced copays and deductibles.

No matter what plan you select, all health plans will provide specific benefits to consumers. A health plan must provide these services to be listed on an exchange. The following is a list of benefits covered by any plan offered:

-

ambulatory patient services

-

emergency services hospitalization

-

maternity and newborn care

-

mental health and substance use disorder services including behavioral health treatment

-

prescription drugs

-

rehabilitative and habilitative services and devices

-

laboratory services

-

preventive and wellness services and chronic disease management

-

pediatric services (including oral and vision care)

It is important to note that for some small businesses and individuals, dental, vision, disability, life and critical illness policies probably won’t be covered under the various exchange plan options. The Affordable Care Act does not require coverage for these services to be listed on the exchanges. Consumers will most likely have to obtain these coverages through the private market.