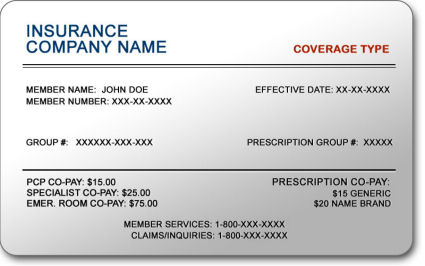

Beginning January 1, 2014, providers will be verifying their patient’s insurance status when they show up for their appointments. Many of these patients may be newly insured individuals who will be getting their health insurance through the Health Insurance Marketplace, also known as Health Insurance Exchange.

Medical Billing Blog

Verifying Patient Coverage in a Health Insurance Marketplace Plan

MBR Explains: Quality Improvements - Key Features of the ACA by Year -- 2011

Continuing our series on the key features of the Affordable Care Act, we will now look into the changes that took effect in 2011 that sought to improve quality and lower cost of healthcare. The majority of these changes effected seniors enrolled in Medicare. The ACA aims to increase the quality and affordability of health insurance, lower the uninsured rate, and reduce the costs of healthcare for individuals and the government. However, a number of the mechanisms – mandates, subsidies, and insurance exchanges – are to be rolled out over four years and beyond. Below is an overview of some of the key quality improvement provisions that took effect in 2011.

Health Insurance in 2014: Lower Premiums but Higher Deductibles

Details are now available on the costs associated with health plans being offered through Healthcare.gov, and some people are finding their insurance will cost more than they had hoped. Until last week, the federal government blocked users from viewing deductible amounts associated with available health plans, limiting consumers to view only premium and copayment amounts. Insurers assumed consumers would pick plans mainly on price, as reflected in the monthly premium, so it was to their advantage, as well as to the government’s, that consumers were unable to view a plan’s annual deductible, or the amount consumers need to pay before coverage kicks in. The federal government finally relented and allowed consumers to basically ‘window shop’ for coverage. For policies offered in the federal exchange, the annual deductible often tops $5,000 for an individual and $10,000 for a couple. The average individual deductible for what is called a bronze plan on the exchange is $5,081 a year, according to a new report on insurance offerings in 34 of the 36 states that are relying on the federally run marketplace. While the costs of these plans are surprising many, they are more generous than what is currently available in the individual market. However, the plans are significantly less generous than what most employers are providing, creating a sticker shock sensation to consumers that are no longer receiving employer-sponsored health insurance.

Healthcare.gov Enrollment Numbers Start to Rise

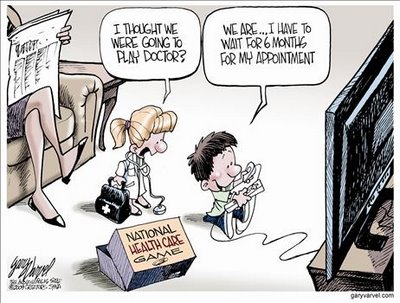

MBR Explains: Increasing Access - Key Features of the Affordable Care Act by Year -- 2010

Continuing our series on the key features of the Affordable Care Act, we will now look into the changes that took effect in 2010 that sought to increase access to affordable healthcare. As previously mentioned, the Patient Protection and Affordable Care Act was signed by President Obama on March 23, 2010. The law aims to increase the quality and affordability of health insurance, lower the uninsured rate, and reduce the costs of healthcare for individuals and the government. However, a number of the mechanisms – mandates, subsidies, and insurance exchanges – are to be rolled out over four years and beyond. Below is an overview of some of the key provisions aimed to increase access that took effect in 2010.

MBR Explains: The Hospital Value-Based Purchasing Program

Historically, the United Stateshas paid for its healthcare under a fee-for-service (FFS) model. Every visit, test, procedure, and consultation receives an individual fee. It incentivizes volume over quality. It discourages integrated care. And it contributes toAmerica’s high health care expenditures. There have been many attempts to reform our payment system – bundled payments, capitation, episode of care payment, comprehensive care payment – but as of 2009, no state has successfully eliminated the FFS system.

MBR Explains: Quality Improvements - Key Features of the Affordable Care Act by Year -- 2010

Continuing our series on the key features of the Affordable Care Act, we will now look into the changes that took effect in 2010 that sought to improve quality and lower cost of healthcare. As previously mentioned, the Patient Protection and Affordable Care Act was signed by President Obama on March 23, 2010. The law aims to increase the quality and affordability of health insurance, lower the uninsured rate, and reduce the costs of healthcare for individuals and the government. However, a number of the mechanisms – mandates, subsidies, and insurance exchanges – are to be rolled out over four years and beyond. Below is an overview of some of the key quality improvement provisions that took effect in 2010.

MBR Explains: Coverage - Key Features of the Affordable Care Act by Year -- 2010

MBR Explains: President Obama’s New Plan for Canceled Health Policies

Late morning on Thursday, November, 14th, President Obama proposed a plan to allow insures to extend policies that existed on October 1st to existing customers through the end of 2014. In the majority of cases, these plans are less expensive policies, but offer none of the new essential benefits that are guaranteed under the Patient Protection and Affordable Care Act. Before any cancellation notice was ever sent out, the writers of the PP-ACA included a ‘grandfathered’ clause in the original law. Even though they did not meet the law’s standards, if they were purchased before March 2010 and neither the policy holder nor the insurer made any substantial changes, it was legal for the policy to be sold. On Thursday, the President expanded the net of policies that fall under this clause.

MBR Explains: The Affordable Care Act’s Reinsurance Tax

During the government shutdown, there was a lot of talk about the Affordable Care Act, specifically the Act’s Reinsurance Tax, which would provide relief to insurers which cover large numbers of high-cost medical cases. In their proposal to open the government, members of the Senate included a one year delay in the tax's implementation. Even though the federal government opened last week, both houses are still negotiating the fine details of their compromise. While we all wait for Congress, MBR explains what the Reinsurance tax is.