Although the final ICD-10 implementation date has not been set, it’s important to continue planning for the transition. The switch to ICD-10 will affect every aspect of how your organization provides care, from software/hardware upgrades to documentation, and even reimbursement issues. Take time to assess everything from coding and documentation to interfaces, training and financial implications. Some areas that require special attention include:

Medical Billing Blog

Three Things Medical Practices Should Do To Prepare For ICD-10

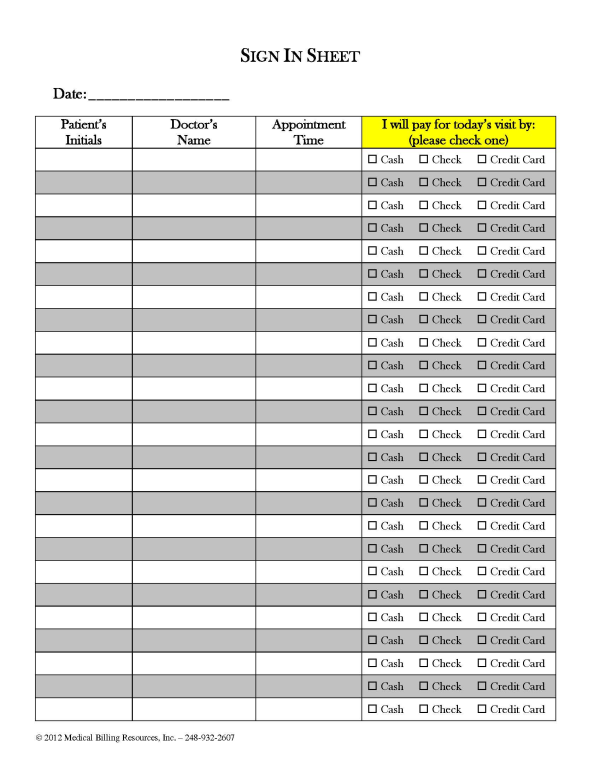

Easy Ways To Increase Front Desk Collections

As I’ve stated before, with a little extra effort on the part of your front desk staff, it’s easy to increase front desk collections and reduce patient receivables. Many front office personnel don’t like to ask for money at the time of service, but it becomes a little easier to begin the conversation with the help of the new sign in form we have designed, which brings up the topic of payment without your front desk staff having to say one word. Mind you, it’s still up to the provider or administrator to institute and enforce a new policy calling for this method of collection effort to be followed, but it does become less distasteful if staff approach the conversation with the help of this new tool.

How Medical Practices Can Reclaim Lost Revenue From Denials

What if I told you that you have been paying $48,000 a year, every year, for the privilege of chatting with your patients about their ailments, and treating them at no charge? You’d tell me I was off my rocker and that you’ve never done such a thing.

Maximize Reimbursement from Incident-To Billing

By Ralph Sitler III, JD -- Non-physician providers play an important role in medical practices these days, including nurse practitioners and a host of others. Understanding how Medicare recognizes these midlevel providers for reimbursement purposes is important for any practice utilizing their services. Compliance with Medicare guidelines for this type of billing is important if you want to be reimbursed correctly and stay on the right side of regulatory bodies.

Why Every Medical Practice Should Have A Code Of Conduct

In this era of heavy regulation, it’s mandatory that medical practices have a compliance program, and the back bone of every compliance plan is a Code of Conduct. The Code is a written set of principles that is used to guide decisions and behaviors within the office. Simply put, it’s a set of rules governing responsibilities and proper practices; it’s the standard of ethics the practice owners pass down to every employee in the office.

What Medical Practices Should Do With Credit Balances

What is unclaimed property: Patient credit balances legally belong either to the patient or the state. Even if they’ve been held on your books for a long period of time, they still do not belong to the practice. If credit balances sit “abandoned” for three years or more, the money is considered unclaimed and therefore the property of the state. This is true whether the balance belongs to a current patient, past patient, deceased patient, or any other permutation of a patient. In most states, unclaimed property laws that pertain to the healthcare industry focus on insurance and patient credit balances. By state law, when this abandonment occurs, the practice is obligated to turn the money over to the state.

Using Established Patient E/M Codes To Maximize Reimbursement

By Christina Hussan -- When a provider has not seen a patient for three or more years, it is permitted to bill for a new patient office visit. Actually, the time period is “three years plus one day,” to be exact, but the rules change when the patient has seen other providers in the group during the interim. It goes like this: If a patient has not seen any provider in a practice in three years (plus one day!), then it is appropriate to bill for a new patient office visit, but if any provider in the practice has seen the patient at any time within that three year period, it is required that the billing go through for an established patient visit.

Proper Use of Modifier 59 Can Increase Revenue for Medical Practices

By Heather Lakner, CPC -- Modifier 59 can be used in appropriate circumstances to unbundle codes to make them separately payable under Medicare guidelines. This can mean an increase in revenue for medical practices in circumstances when this modifier is appended correctly, with proper documentation to support its use. Unfortunately, Modifier 59 is often used incorrectly. Many billers will append it to a service to override an edit, but this can set up their medical practice for a substantial audit risk if it is applied incorrectly, or if cirumstances in the patient’s medical record do not clearly indicate that its use is appropriate.

Why Medical Practices Should Opt In For Electronic Funds Transfer

Don’t you hate sitting in traffic trying to get to the bank before they close so you can deposit those long-awaited and keenly needed insurance payment checks? It’s time for medical practices to stop wasting time and opt in to programs that allow payers to credit your bank accounts with payments for services you’ve rendered to patients. In fact, as of January 1, 2014, use of electronic funds transfer (EFT) services will be required for all health plans, as provided for in the Patient Protection and Affordable Care Act of 2010.

As insurance premiums continue to rise, employers and consumers are switching to lower cost, high-deductible plans in record numbers. Because of this, patient payments are accounting for a larger portion of a physician’s revenue, and this trend should continue for the foreseeable future. This results in collection challenges, with providers writing off an estimated $65 billion in patient bad debt in 2010, according to McKinsey Quarterly 2010. In order to reduce bad debts, our industry is emphasizing multiple remedies, including increasing front desk collections, implementing online bill pay options, and offering patient payment plans. All of these are convenient options for patients to make payments on their bill that also help to keep those reimbursements out of the bad debt column.