With just a month left for Americans to select health plans this year through new insurance marketplaces, the Obama administration is bending some rules to prevent people from being stranded without coverage, especially those in states where their own state-run online exchange has failed disastrously. The new policy applies to people who — because of “technical issues” — were prevented in trying to buy insurance through an online exchange and signed up for a health plan outside the marketplace. They will now be allowed to sign up for coverage in the exchange and get federal subsidies “on a retroactive basis,” going back to the date on which they first enrolled in a health plan outside the exchange. The state-run exchanges in some of these states — Oregon, Maryland, Massachusetts and Hawaii in particular — have experienced more technical problems than even the federal website. Consumers in those states are still having difficulty enrolling five months after the launch. Federal officials said they had agreed to provide such assistance retroactively because technical problems had prevented consumers from using online exchanges to obtain insurance and financial aid in some states. The Obama administration’s decision came as a surprise because the Affordable Care Act is clear: Federal subsidies are available only to people who enroll in a “qualified health plan” through an exchange. The HHS change will allow those who tried to sign up on their state-run exchanges, but couldn’t, to retroactively obtain the subsidies they would have been eligible for, even if they ended up purchasing healthcare through a private insurer. The privately purchased plans must still meet certain basic requirements of the healthcare law.

Medical Billing Blog

Now Available: Subsidies for Insurance Policies Bought Outside Exchange

Marketplace Enrollment Update: February 2014

Enrollment in health plans sold on marketplaces created by President Obama’s health care law has hit 4 million, the administration announced Tuesday, marking another milestone in the law’s implementation. The number suggests sign-ups have continued at a brisk pace in February, with about 700,000 people selecting an insurance plan so far this month. And with five weeks before the enrollment period deadline at the end of March, they put the administration on pace to come close to the Congressional Budget Office's initial projection that 7 million individuals would sign up for insurance coverage during the period. Health officials continue to see “strong demand nationwide” and that more than 12 million calls have come into the federal call center since the fall. But with the good news remain some questions. The number of people who have signed up for plans and paid their first month's premium remains unknown, though insurers have suggested about 20 percent of individuals have not paid. Moreover, it is unclear how many of those individuals who signed up in February were young and healthy -- the population demographic that the administration needs to ensure that the exchanges have a stable balance of healthy and sick consumers. A senior administration official said that a more detailed report about the enrollees would be released in mid-March.

Healthcare.gov's Payment System Months from Completion

The federal government may not completely finish the automated payment system for Healthcare.gov for “several months,” White House spokesman Jay Carney said Friday. Until that system is fully running, the administration won’t be able to verify how many of the consumers who signed up for through the health insurance website are, in fact, paying their premiums and are hence truly enrolled. The administration reported earlier in the week that nearly 3.3 million people have selected plans on through the marketplace as of Feb. 1. However, insurance companies are saying that about 20 percent of those people failed to pay their premiums on time and consequently didn’t receive coverage in January, the New York Times reports. Paying the first month’s premium is the final step in completing an enrollment. Under federal rules, people must pay the initial premium to have coverage take effect. In view of the chaotic debut of the federal marketplace and many state exchanges, the White House urged insurers to give people more time, and many agreed to do so. But, insurers said, some people missed even the extended deadlines.

Marketplace Enrollment Update: January 2014

Approximately 3 million people have now enrolled in health insurance plans sold through marketplaces created by President Obama’s health law, the administration announced Friday. The milestone indicates nearly a million additional people have signed up since the end of December. It also suggests that the marketplaces are continuing to recover from a disastrous launch on Oct. 1. That still leaves the Obama administration lagging behind its initial projections for overall health law enrollment--but also closer to hitting monthly sign-up expectations it set back in September. The numbers are reassuring for supporters of the Affordable Care Act, who were worried that the pace of sign-ups for private plans would slow in January and February, before picking up again as the March 31 enrollment deadline for 2014 coverage approached. But they are still shy of initial projections from the Centers for Medicare and Medicaid Services, which originally expected 4.4 million people to sign up for a plan by the end of January. Moreover, the administration has not provided data on how many of the people who have signed up for plans through the exchanges have actually made a payment, which is required to ensure coverage.

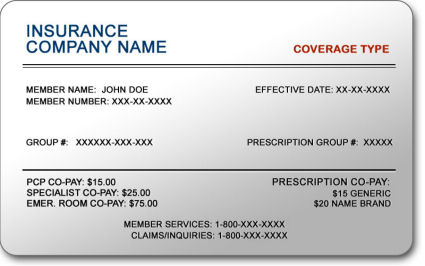

Verifying Patient Coverage in a Health Insurance Marketplace Plan

Beginning January 1, 2014, providers will be verifying their patient’s insurance status when they show up for their appointments. Many of these patients may be newly insured individuals who will be getting their health insurance through the Health Insurance Marketplace, also known as Health Insurance Exchange.

Health Insurance in 2014: Lower Premiums but Higher Deductibles

Details are now available on the costs associated with health plans being offered through Healthcare.gov, and some people are finding their insurance will cost more than they had hoped. Until last week, the federal government blocked users from viewing deductible amounts associated with available health plans, limiting consumers to view only premium and copayment amounts. Insurers assumed consumers would pick plans mainly on price, as reflected in the monthly premium, so it was to their advantage, as well as to the government’s, that consumers were unable to view a plan’s annual deductible, or the amount consumers need to pay before coverage kicks in. The federal government finally relented and allowed consumers to basically ‘window shop’ for coverage. For policies offered in the federal exchange, the annual deductible often tops $5,000 for an individual and $10,000 for a couple. The average individual deductible for what is called a bronze plan on the exchange is $5,081 a year, according to a new report on insurance offerings in 34 of the 36 states that are relying on the federally run marketplace. While the costs of these plans are surprising many, they are more generous than what is currently available in the individual market. However, the plans are significantly less generous than what most employers are providing, creating a sticker shock sensation to consumers that are no longer receiving employer-sponsored health insurance.