By Ralph Sitler III, JD -- It’s important for health care providers to determine how the services rendered will be paid, and who is responsible for payment. Since financial responsibility often falls on a guarantor other than the patient, it can be a can of worms to try to figure out where to send the bill for certain patients under certain circumstances. For example, it can be difficult to assess financial responsibility when treating minors. This is because minors can fall into any of several demographic categories when treatment is sought, and can even authorize their own care in some instances. Because of this situational power to authorize their own care, the parents or guardians of a minor may at times disclaim financial responsibility for services rendered to the child. So if a bill goes unpaid, can you pursue the parent or guardian for payment? Maybe, maybe not.

Medical Billing Blog

What You Need To Know About Payment For Service To Minors

Practice Management Considerations During EMR Chart Conversion

With the advent of Electronic Medical Records implementation industry wide, it is likely that you too have taken the plunge and purchased an electronic solution for your practice’s patient management. But once you’ve purchased your Electronic Medical Record (EMR) you will also have to decide what to do with your existing patient files, and figure out the best way to use them in conjunction with your new EMR. When beginning any medical chart conversion effort, it is important to make sure the information you’re loading into your EMR will be of the most value to you on a day to day basis. It’s a good idea to determine which patients are active, and which are no longer likely to seek care from your practice. In most cases, patients who have not been in to seek care for a period of 18 to 24 months would be classified as inactive. In the case of these patients, it doesn’t make sense to spend a lot of time and energy importing their charts to the EMR, so records for these patients can be moved to your archives, and retrieved in the event they do happen to return for care. You can then convert the chart prior to their visit, and have the information in the electronic format when they come back.

Three Things Medical Practices Should Do To Prepare For ICD-10

Although the final ICD-10 implementation date has not been set, it’s important to continue planning for the transition. The switch to ICD-10 will affect every aspect of how your organization provides care, from software/hardware upgrades to documentation, and even reimbursement issues. Take time to assess everything from coding and documentation to interfaces, training and financial implications. Some areas that require special attention include:

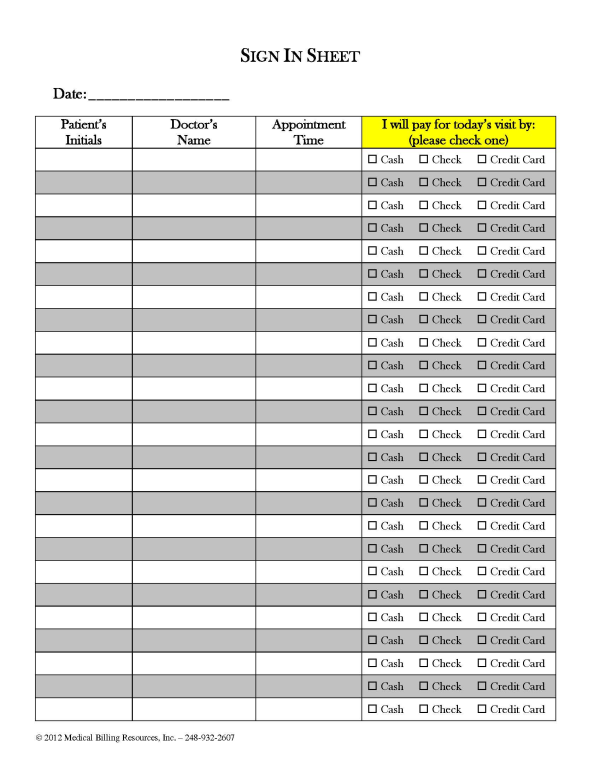

Easy Ways To Increase Front Desk Collections

As I’ve stated before, with a little extra effort on the part of your front desk staff, it’s easy to increase front desk collections and reduce patient receivables. Many front office personnel don’t like to ask for money at the time of service, but it becomes a little easier to begin the conversation with the help of the new sign in form we have designed, which brings up the topic of payment without your front desk staff having to say one word. Mind you, it’s still up to the provider or administrator to institute and enforce a new policy calling for this method of collection effort to be followed, but it does become less distasteful if staff approach the conversation with the help of this new tool.

How Medical Practices Can Reclaim Lost Revenue From Denials

What if I told you that you have been paying $48,000 a year, every year, for the privilege of chatting with your patients about their ailments, and treating them at no charge? You’d tell me I was off my rocker and that you’ve never done such a thing.

Why Every Medical Practice Should Have A Code Of Conduct

In this era of heavy regulation, it’s mandatory that medical practices have a compliance program, and the back bone of every compliance plan is a Code of Conduct. The Code is a written set of principles that is used to guide decisions and behaviors within the office. Simply put, it’s a set of rules governing responsibilities and proper practices; it’s the standard of ethics the practice owners pass down to every employee in the office.

What Medical Practices Should Do With Credit Balances

What is unclaimed property: Patient credit balances legally belong either to the patient or the state. Even if they’ve been held on your books for a long period of time, they still do not belong to the practice. If credit balances sit “abandoned” for three years or more, the money is considered unclaimed and therefore the property of the state. This is true whether the balance belongs to a current patient, past patient, deceased patient, or any other permutation of a patient. In most states, unclaimed property laws that pertain to the healthcare industry focus on insurance and patient credit balances. By state law, when this abandonment occurs, the practice is obligated to turn the money over to the state.

Why Medical Practices Should Opt In For Electronic Funds Transfer

Don’t you hate sitting in traffic trying to get to the bank before they close so you can deposit those long-awaited and keenly needed insurance payment checks? It’s time for medical practices to stop wasting time and opt in to programs that allow payers to credit your bank accounts with payments for services you’ve rendered to patients. In fact, as of January 1, 2014, use of electronic funds transfer (EFT) services will be required for all health plans, as provided for in the Patient Protection and Affordable Care Act of 2010.

As insurance premiums continue to rise, employers and consumers are switching to lower cost, high-deductible plans in record numbers. Because of this, patient payments are accounting for a larger portion of a physician’s revenue, and this trend should continue for the foreseeable future. This results in collection challenges, with providers writing off an estimated $65 billion in patient bad debt in 2010, according to McKinsey Quarterly 2010. In order to reduce bad debts, our industry is emphasizing multiple remedies, including increasing front desk collections, implementing online bill pay options, and offering patient payment plans. All of these are convenient options for patients to make payments on their bill that also help to keep those reimbursements out of the bad debt column.

Medical Billing Resources yesterday launched a new website with features designed to be of greater help to its clients and the healthcare community at large.