Fall is enrollment season for many people who get insurance through their workplace. Premium increases for 2015 plans are expected to be modest on average, but the shift toward higher out-of-pocket costs overall for consumers will continue as employers try to keep a lid on their costs and incorporate health law changes.

Medical Billing Blog

Modest Premium Hikes, Higher Consumer Costs Likely For Job-Based Plans

Some Premiums up, some Premiums down for 2015 Healthcare.gov

According to study by the Kaiser Family Foundation analyzing ACA Benchmark premiums in the largest cities from 15 states and the District of Columbia, there will be a mixture of premium increases and premium decreases for the benchmark Silver plans in 2015. While many of the Silver plans sold on the Exchanges in 2014 will charge higher premiums in 2015, the new plans being sold on these Exchanges will have prices below (in some cases well below) the prices for the returning plans.

HHS Report Details ACA Premium Subsidy Use And Cost

Federal officials on Wednesday released new data about who enrolled in the federal health marketplace plans for 2014, how much the law’s subsidies helped offset the cost and how many plans people from could choose from, among other details.

Health care spending rose at the fastest pace since 1980 as the new health insurance law prompted many more Americans to seek medical treatment. “Following several years of decline, 2013 was striking for the increased use by patients of all parts of the U.S. health care system,” Murray Aitken, executive director of the IMS Institute for Healthcare Informatics, said in a statement. Health care expenditures climbed at a 9.9% annual rate last quarter, mostly because of increased spending at hospitals, the Bureau of Economic Analysis said last week. That's the biggest jump since 1980's third quarter, and it followed a 5.6% increase in the fourth quarter of 2013.

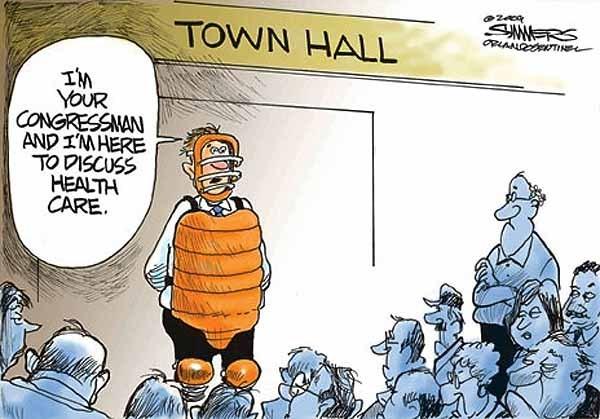

Proposed Fiscal Budget 2015 - A Healthcare Analysis

On Tuesday, March 4, the Office of Management and Budget (OMB) released the President’s budget for Fiscal Year (FY) 2015. This budget is not a binding document and will likely result in no real action. The President’s budget is considered an indication of the President’s priorities for the upcoming fiscal year. It is important to understand the budget because certain provisions of it may be included in future proposals and legislation.

According to study, America has 32 million underinsured.

As Monday's deadline to sign up for health insurance or face a penalty approaches, there's plenty of attention on the uninsured. But how about the underinsured? A new report finds that 32 million people were underinsured in the U.S. in 2012, meaning their health insurance didn’t do enough to protect them from major medical costs, according to a new report from the Commonwealth Fund. That makes for 80 million Americans who either have no health insurance at all, or who don’t have enough, the report finds. The Affordable Care Act insurance reforms seek to expand coverage and to improve the affordability of care and premiums.

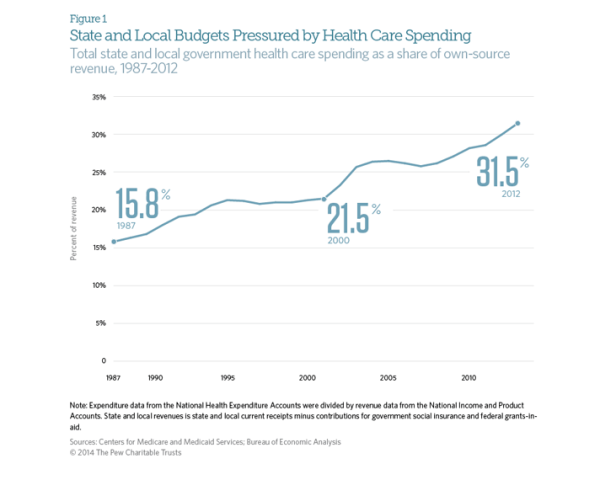

State and Local Governments Spend 31.5% on Healthcare

The Affordable Care Act was supposed to stem the rapidly rising cost of healthcare in the United States. While costs have continued to rise since the ACA’s passage in 2010, the rate has slowed dramatically. Early indicators suggest that the growth rate of total healthcare spending in the US was only 4% in 2012. This is an improvement when looking at the aggregate expenditures, unfortunately, for state and local governments, the cost curve has not had any form of reduction. According to CMS and the Bureau of Economic Analysis, state and local governments spent 31.5% of their budgets on healthcare costs in 2012. That represents an 8 percent increase over the previous year, or a rate twice as fast as the national rate of increase. This increase is largely due in part to the stimulus bill passed by Congress in 2009. The American recovery and Reinvestment Act granted more than $100 billion to states to cover increasing Medicaid costs, which had ballooned during the recession as high unemployment drove job-seekers to the government run health program. During this period, even though Medicaid saw increased participants, overall state spending on Mediciad actually fell. However, the federal stimulus money would not last forever and State Mediciad expenditures rose 22 percent between 2010 and 2011, and another 15 percent in 2012. The Government Accountability Office says health-care spending represents the single greatest threat to state and local government long-term health.

City of Detroit and Retirees Reach Agreement on Health Insurance

The city of Detroit and its retirees have reached an agreement in a health insurance dispute that may end a lawsuit against the city. Retirees filed suit in November to stop the city from shifting them to Medicare and giving those under age 65 a $125 monthly stipend to buy their own insurance. The parties reached an agreement in principle Thursday night covering benefits through the end of 2014, mediators in Detroit's bankruptcy said Friday in a statement. Some features of the deal include the increase to $300 in the monthly stipend for retirees over age 65 who aren't eligible for Medicare. The stipend for retirees under age 65 will be increased to $175 if the household income is less than $75,000 and the retiree acquires insurance under a health care exchange. The stipend is $50 more than the amount proposed last year by emergency manager Kevyn Orr. A lawsuit retiree groups filed in bankruptcy court Jan. 9 challenging the city’s plan to slash benefits will be dismissed as a result of the settlement, according to a statement from the Detroit bankruptcy court mediators.

Health Insurance in 2014: Lower Premiums but Higher Deductibles

Details are now available on the costs associated with health plans being offered through Healthcare.gov, and some people are finding their insurance will cost more than they had hoped. Until last week, the federal government blocked users from viewing deductible amounts associated with available health plans, limiting consumers to view only premium and copayment amounts. Insurers assumed consumers would pick plans mainly on price, as reflected in the monthly premium, so it was to their advantage, as well as to the government’s, that consumers were unable to view a plan’s annual deductible, or the amount consumers need to pay before coverage kicks in. The federal government finally relented and allowed consumers to basically ‘window shop’ for coverage. For policies offered in the federal exchange, the annual deductible often tops $5,000 for an individual and $10,000 for a couple. The average individual deductible for what is called a bronze plan on the exchange is $5,081 a year, according to a new report on insurance offerings in 34 of the 36 states that are relying on the federally run marketplace. While the costs of these plans are surprising many, they are more generous than what is currently available in the individual market. However, the plans are significantly less generous than what most employers are providing, creating a sticker shock sensation to consumers that are no longer receiving employer-sponsored health insurance.

MBR Explains: Quality Improvements - Key Features of the Affordable Care Act by Year -- 2010

Continuing our series on the key features of the Affordable Care Act, we will now look into the changes that took effect in 2010 that sought to improve quality and lower cost of healthcare. As previously mentioned, the Patient Protection and Affordable Care Act was signed by President Obama on March 23, 2010. The law aims to increase the quality and affordability of health insurance, lower the uninsured rate, and reduce the costs of healthcare for individuals and the government. However, a number of the mechanisms – mandates, subsidies, and insurance exchanges – are to be rolled out over four years and beyond. Below is an overview of some of the key quality improvement provisions that took effect in 2010.